Consumer Lending QC Software

Proven to improve audit output by over 50%

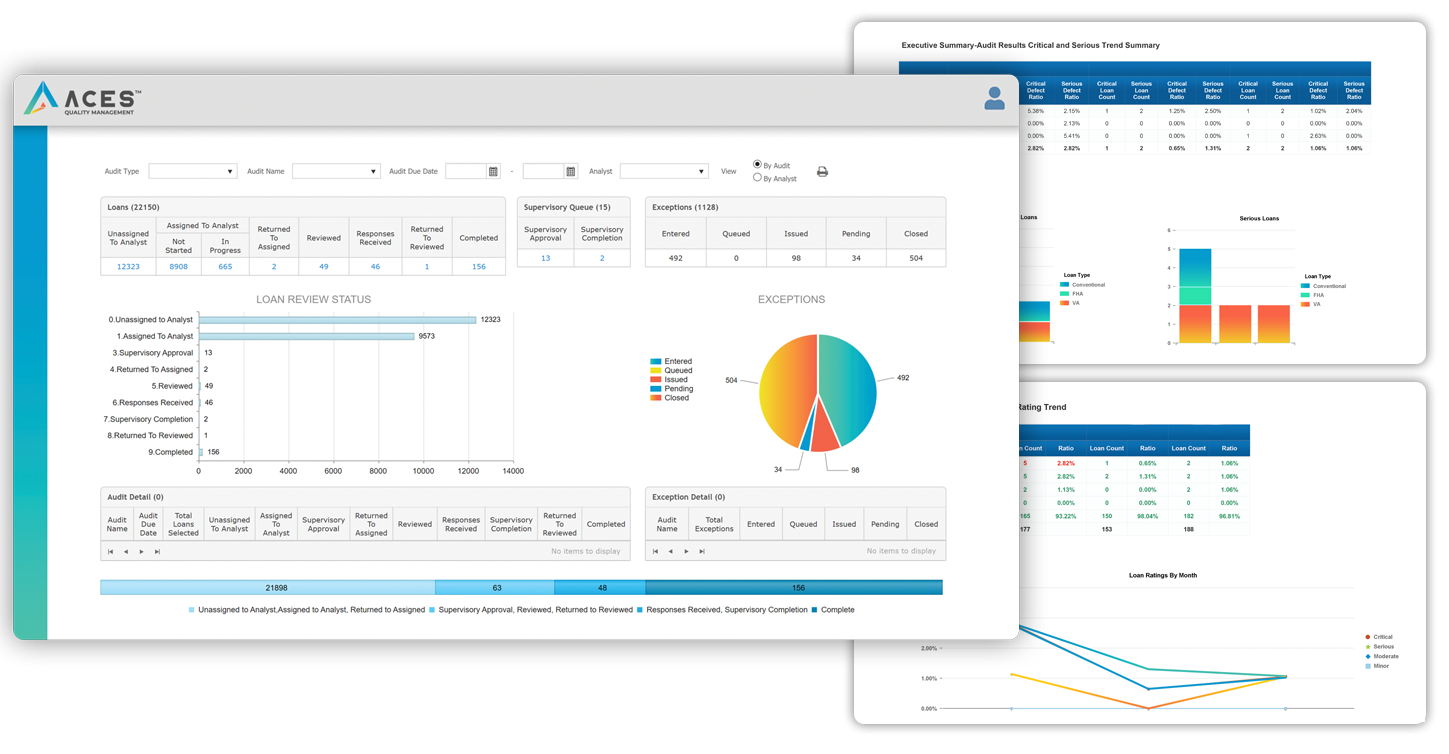

With ACES Quality Management and Control, consumer banks can leverage a single platform to obtain a holistic view of loan quality and gain valuable insights across all lending channels. Consumer Lenders can improve productivity and quality while controlling costs and risk in auto, indirect lending, home equity, credit card, account opening, and unsecured lending.

- REVIEW: Increase loan review speed while reducing defects.

- REPORT: Produce executive-level reports in minutes v. days and gain real-time insights to make more informed business decisions.

- REMEDIATE: Collaborate securely to monitor key data and metrics, review audit activity, remediate defects and manage corrective actions in real-time.