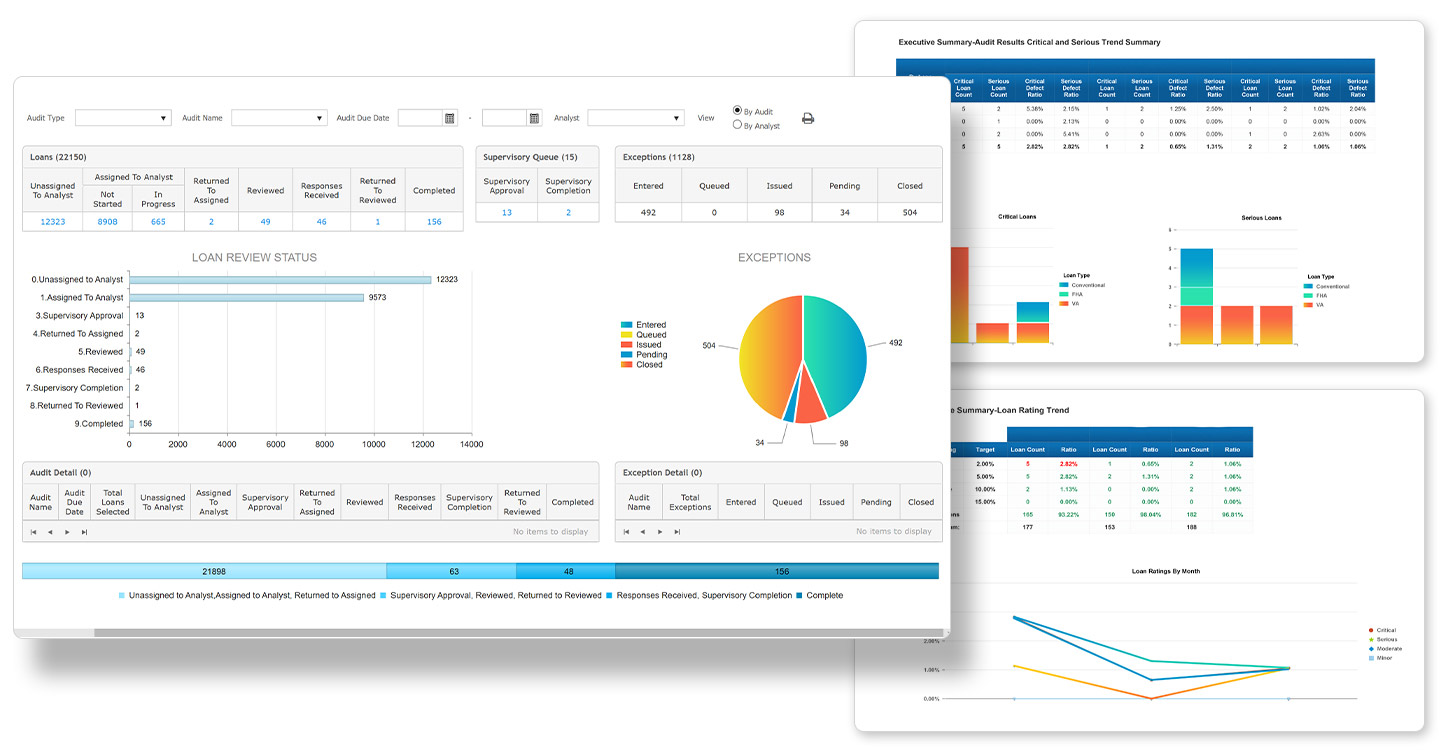

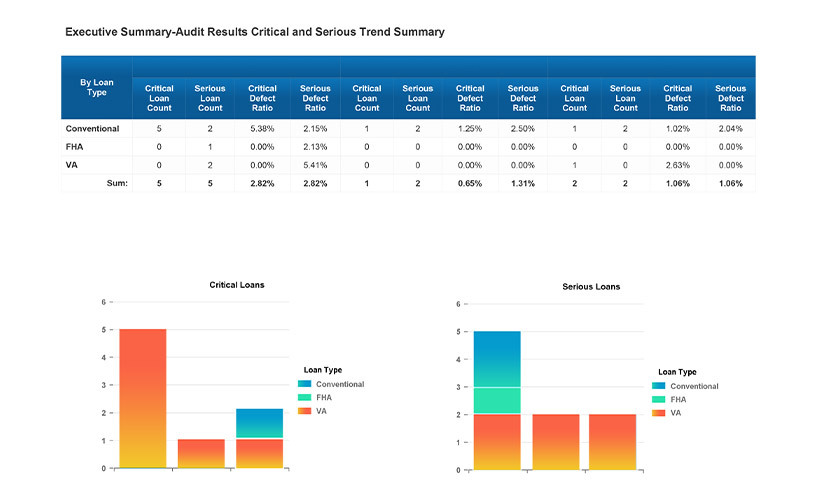

View example reports available with ACES.

Gain Credibility And Confidence In Your Compliance And Audit Process

The need for loan quality and risk mitigation does not stop once the loan origination process has been completed. With ACES Quality Management and Control, loan servicers are able to tackle all servicing QC challenges while keeping pace with ever-changing regulatory requirements to ensure quality throughout the life of the loan.

Learn more about ACES