Powerful technology to reduce risk exposure and deliver insights for better strategies moving forward

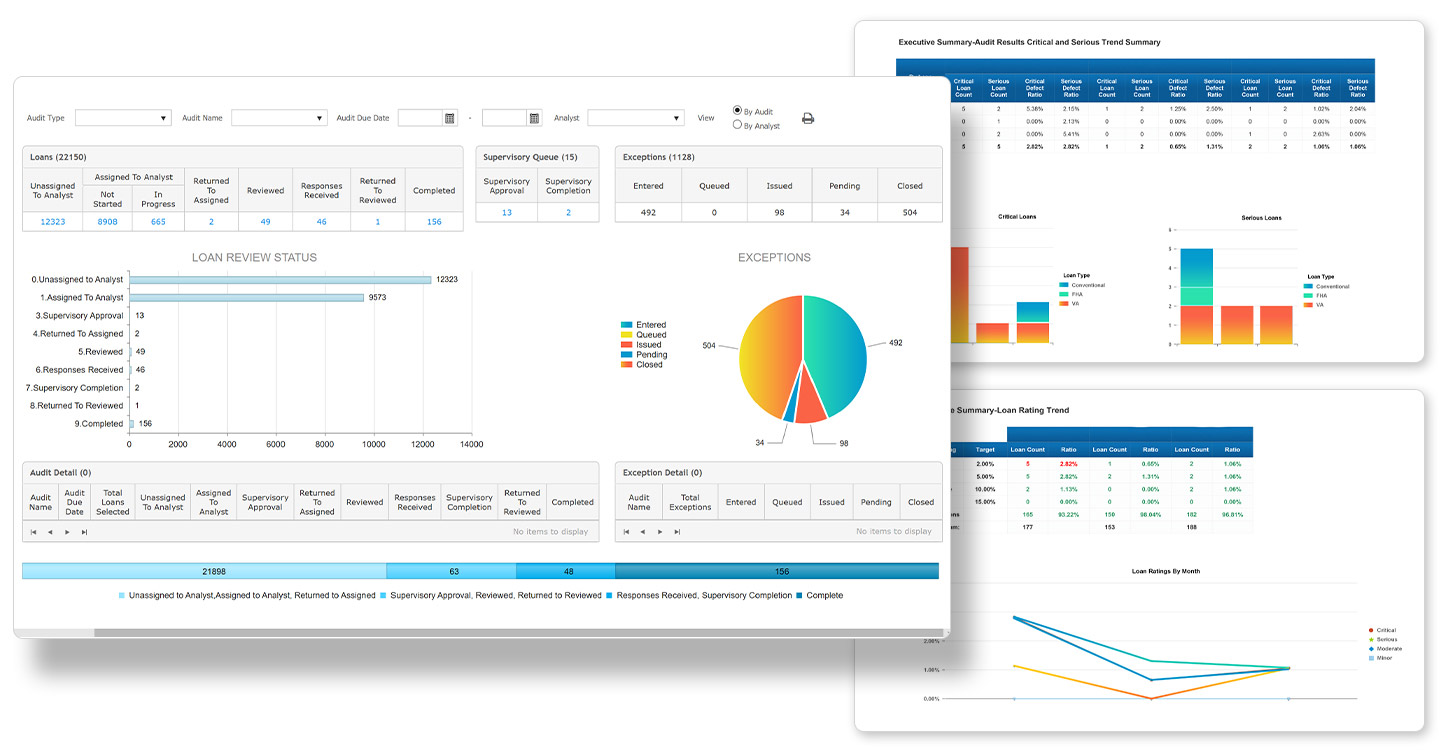

While bigger risks often net greater rewards, commercial lenders know all too well how quickly those rewards can disappear when loan defects and/or regulatory compliance errors occur. ACES Quality Management and Control protects those rewards by providing commercial lenders with powerful auditing and fraud investigation tools to ensure quality and compliance throughout their loan portfolio.

Learn more about ACES