Leverage ACES Flexible Audit Technology®

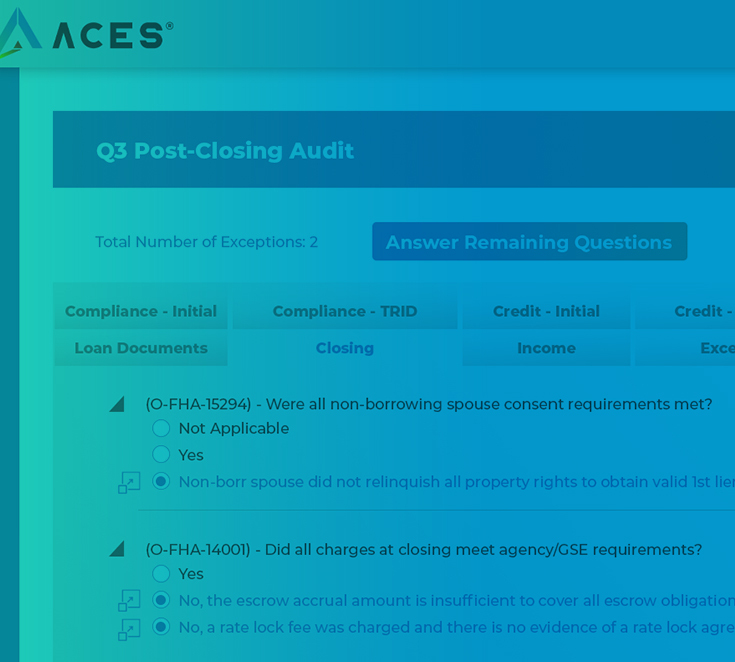

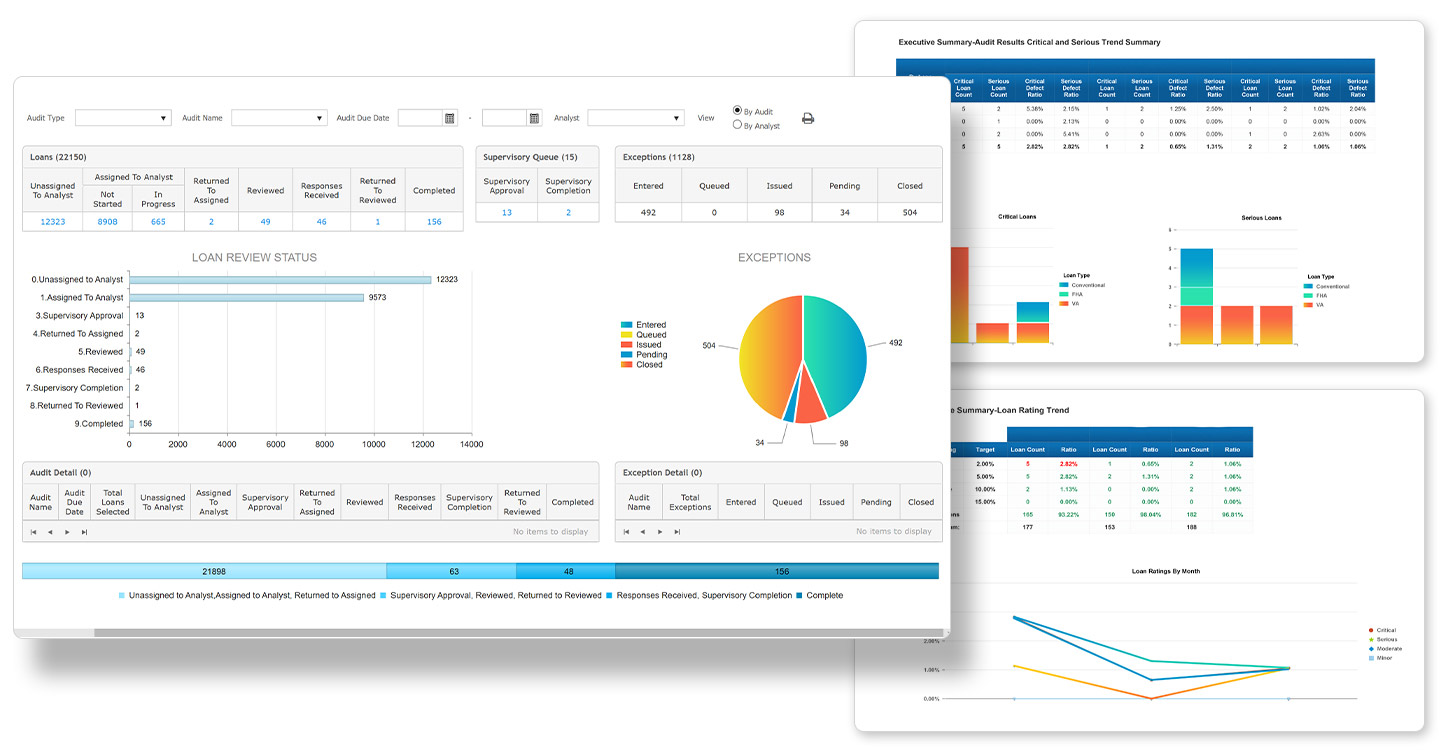

From pre-funding mortgage quality control to post-closing to servicing, there are multiple points across the loan lifecycle where mortgage lenders need to determine the quality of their assets. ACES provides lenders with a single mortgage quality control platform to detect and resolve loan defects, fulfill compliance requirements and reduce legal liability across the entirety of their origination and servicing operations.

Learn more about ACES