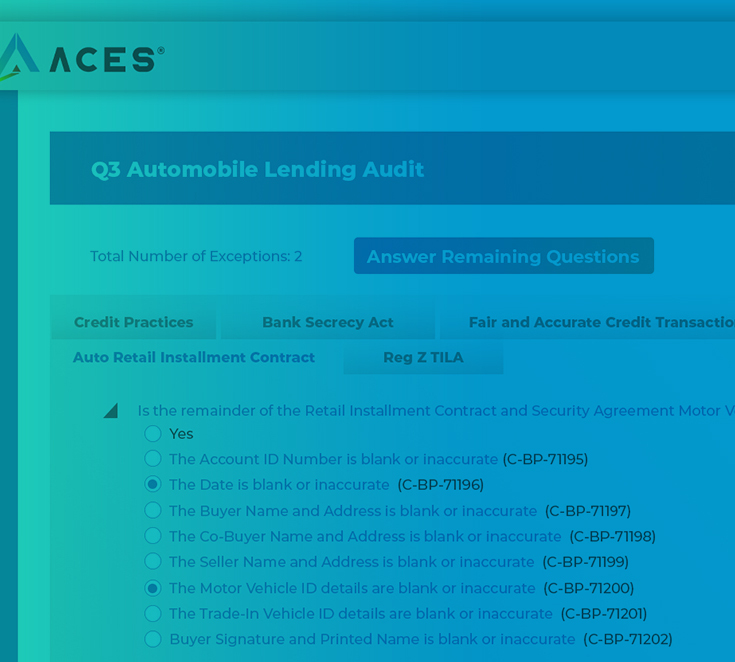

Leverage ACES Flexible Audit Technology® for Consumer Lending

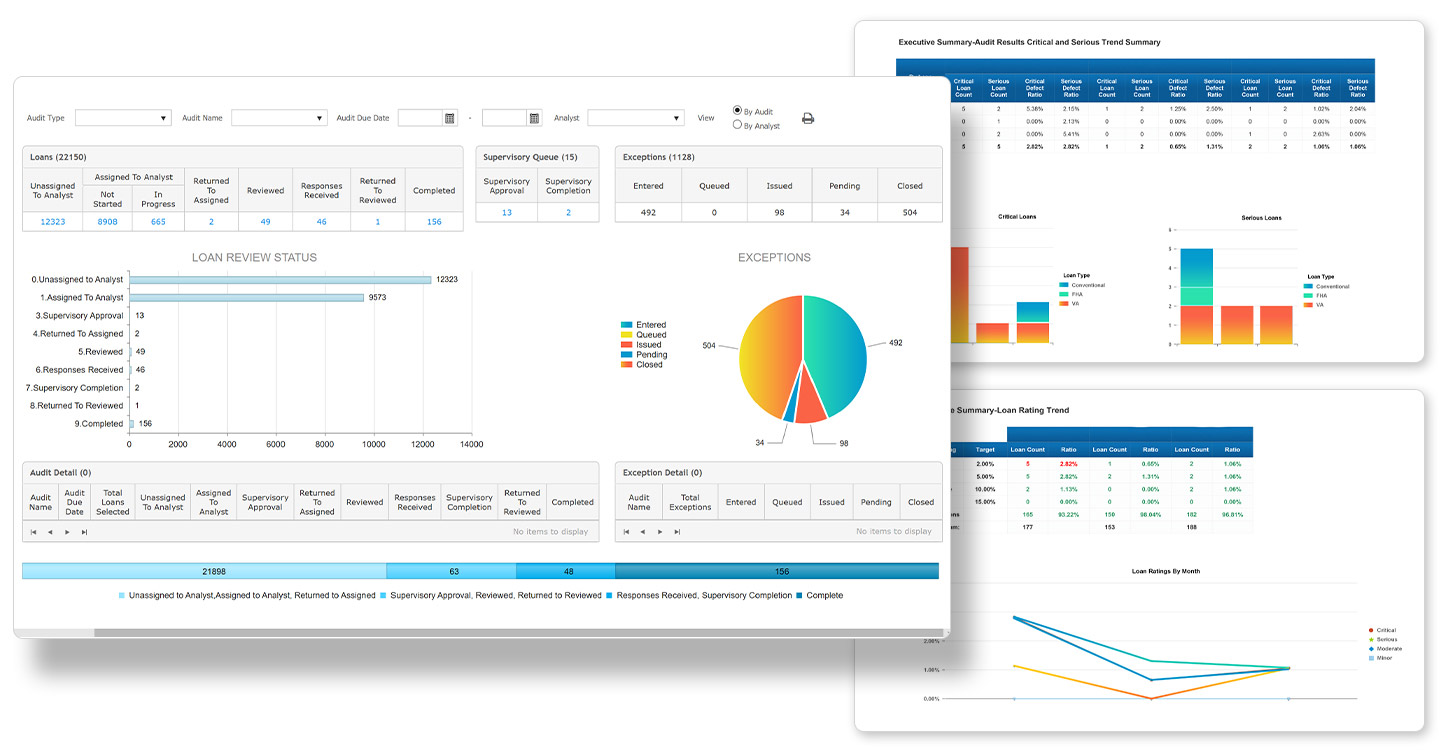

Financial institutions face risk across multiple lines of business, but many have taken a siloed approach to quality control in lending, resulting in reduced productivity and an increase in the cost to comply. With ACES Quality Management and Control, consumer banks and credit unions can leverage a single platform to obtain a holistic view of loan quality and gain valuable insights across all consumer lending channels.

Learn more about ACES