The Enterprise-Grade Loan Quality

Solution for Credit Unions

ACES can improve audit output by over 65%

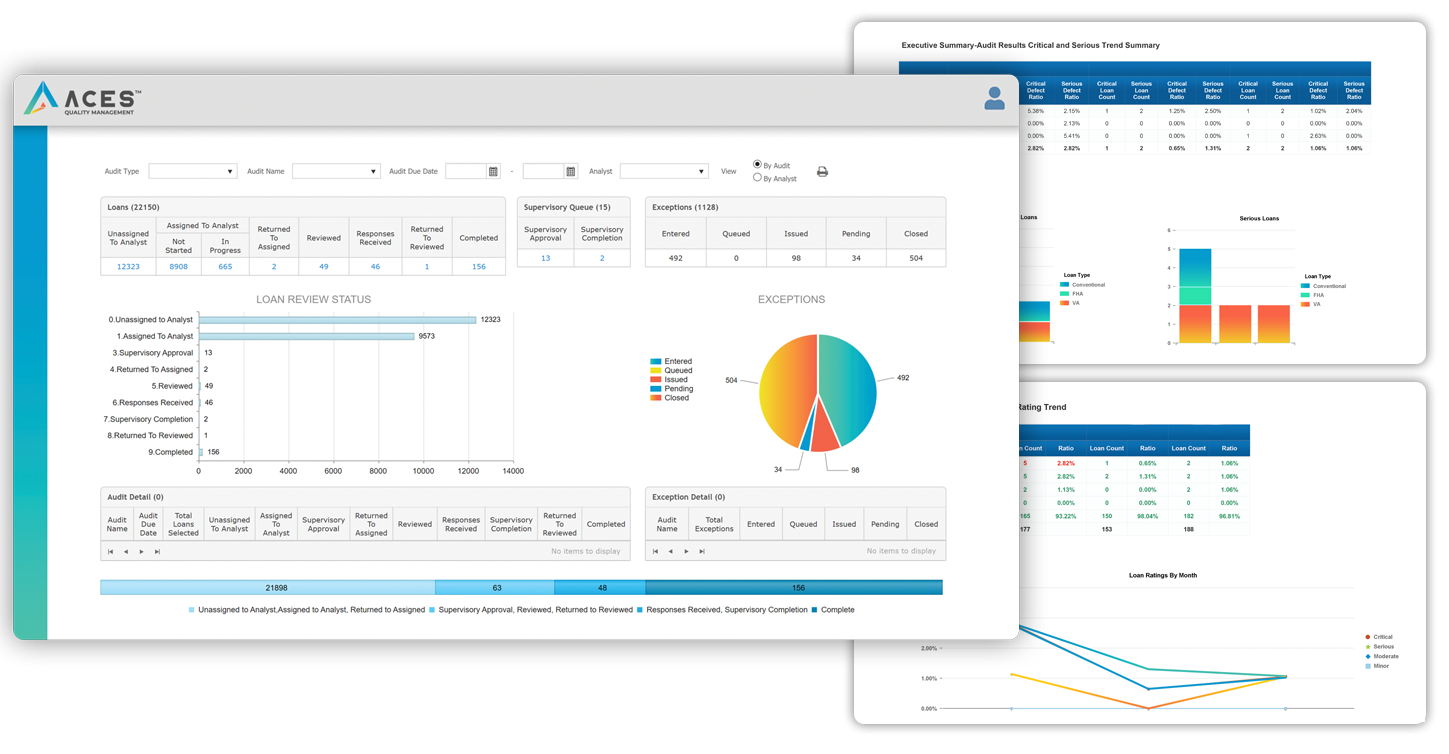

Quality is central to every Credit Unions' mission. With ACES Quality Management and Control, Credit Unions can leverage a single platform to obtain a holistic view of loan quality, apply compliant checklists, and gain valuable quality insights across multiple business lines.