ARMCO’s Mortgage QC Industry Trends Report represents an analysis of quality control findings throughout the United States using extensive data derived from the ACES Analytics® benchmarking software. This report is designed to provide business leaders and mortgage quality control professionals meaningful information on nationwide loan quality trends.

Executive Summary

QC Industry Trends – Overview

QC Industry Trends – by Category

QC Industry Trends – by Loan Purpose

QC Industry Trends – by Loan Type

Conclusion

About this Report

Executive Summary

This report presents industry trends in mortgage quality control for the third quarter of 2016 based on analysis of loan files and defects captured in the ACES Analytics benchmarking system. The ACES Analytics benchmarking dataset includes post-closing quality control data from over 60 lenders, comprising more than 65,000 unique loans. Defects are categorized using the Fannie Mae loan defect taxonomy. An analysis of top-ranking defect categories for 2016 shows that Legal/Regulatory/Compliance and Loan Package Documentation continue to be the leading defect categories.

Report highlights include:

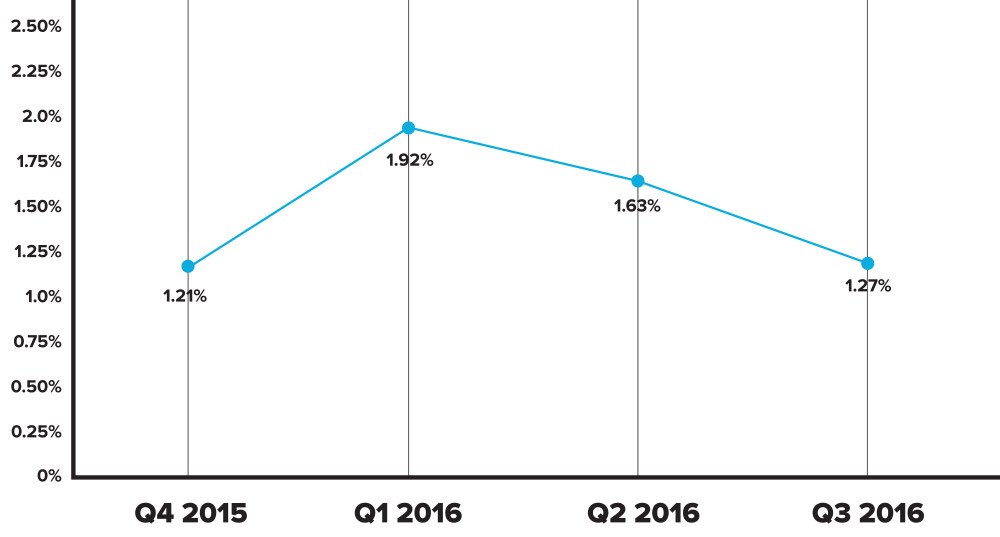

- The benchmark Critical Defect Rate drops to 1.27%, supporting a downward trend after reaching a high of 1.92% in Q1 of 2016.

- Overall defects associated with the Legal/Regulatory/Compliance category jump by over 14%. However, the critical defects within the same category drop to a 12-month low, comprising 22.69% of all critical defects. Changes in lender severity ratings are the cause of this decrease.

- Critical defects associated with Income/Employment lead all categories for “Credit Related Defects”. The top reported critical defects are all associated with the miscalculation of income.

QC Industry Trends - Overview

Figure 1 displays the overall percentage of critical defects reported over the past four quarters. According to the ACES Analytics data, the critical defect rate continues to trend downward, nearing its 12-month low of 1.21% reported in Q4 2015. At 1.27%, the critical defect rate drops by 28.3% in Q3 of 2016, following a 17.8% drop in Q2, providing an overall drop of just over 46% from the high of 1.92% reported in Q1 of 2016.

Critical Defect Rate, Q4 2015 – Q2 2016

Figure 1: Percentage of all critical defects by quarter

QC Industry Trends – By Category

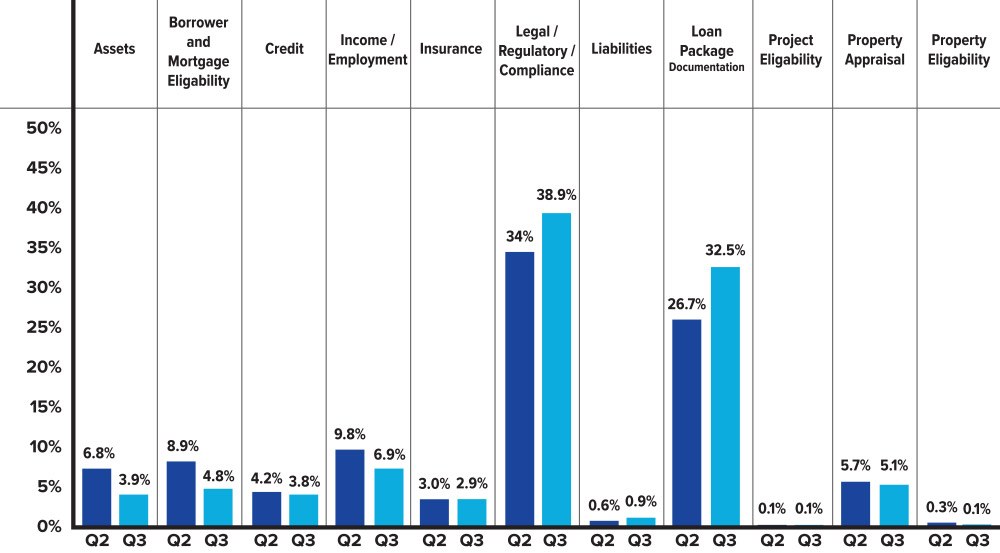

Figure 2 shows a breakdown of reported net defects in accordance with Fannie Mae defect categories along with the distribution of defects found in both Q2 and Q3 of 2016. Legal/Regulatory/Compliance and Loan Package Documentation continue to be the top two defect categories among all loan defects recorded. Moreover, a noticeable jump in the proportion of overall defects associated with both of these categories was recorded. This increase initially raised eyebrows: Q2 data had showed a significant drop in the Legal/Regulatory/Compliance defects. Q2 data, along with input from participating lenders, had indicated that lenders were identifying their TRID-related Legal/Compliance errors and implementing corrective actions that were leading to positive results. Hence, the increase in Legal/Compliance and Loan Package Documentation defects seen in Q3 initially appeared to be a reversal of this trend and was surprising. It prompted us to dive deeper into the analytics to get a better understanding of the increases observed in Legal/Regulatory/Compliance and Loan Package Documentation defects in Q3.

Loan Package Documentation, the second highest defect category making up 32.5% of all reported defects in Q3, continues to be a recurring problem within the loan origination manufacturing process. This defect category has been openly noted as a problem throughout the industry, with efforts to improve varying quarter to quarter. As the second largest contributor of overall defects, the fact that most all the Loan Package Documentation defects are curable and these defects very rarely end up causing a loan to be ineligible for sale, many times reduces the emphasis for corrective action planning.

With regard to the highest reported defect category, Legal/Regulatory/Compliance, what we found in the Q3 data was an interesting phenomenon: Through Q4 of 2015 and the first two quarters of 2016, there was a direct correlation between the overall benchmark critical defect rate and reported Legal/ Regulatory/Compliance (TRID specific) defects. However, in Q3 we noted the following deviation: Reported defects for Legal/Regulatory/Compliance started moving in the opposite direction of the benchmark critical defect rate. Specifically, Legal/Regulatory/Compliance overall reported defects in Q3 increased by just over 14% from the Q2 reported defects; whereas for the same time period, critical defects within the same category decreased by almost 18%.

What prompted this divergence? Our analysis shows this was prompted by changes in the way lenders are measuring severity (i.e. criticality) for these categories of defects. In other words, it’s not that the number of TRID-related defects had fallen – it’s that lenders are refining their understanding of the operational and financial impact that these defects are having on their business and recategorizing many errors from “critical” to “low” or “moderate.” As a result, the overall critical defect rate continued to fall in Q3 even as the errors themselves increased.

Defect Rates by Fannie Mae Category, 2016 Q2 vs. Q3

Figure 2: Breakdown of defects by Fannie Mae categories for Q2 vs. Q3 2016.

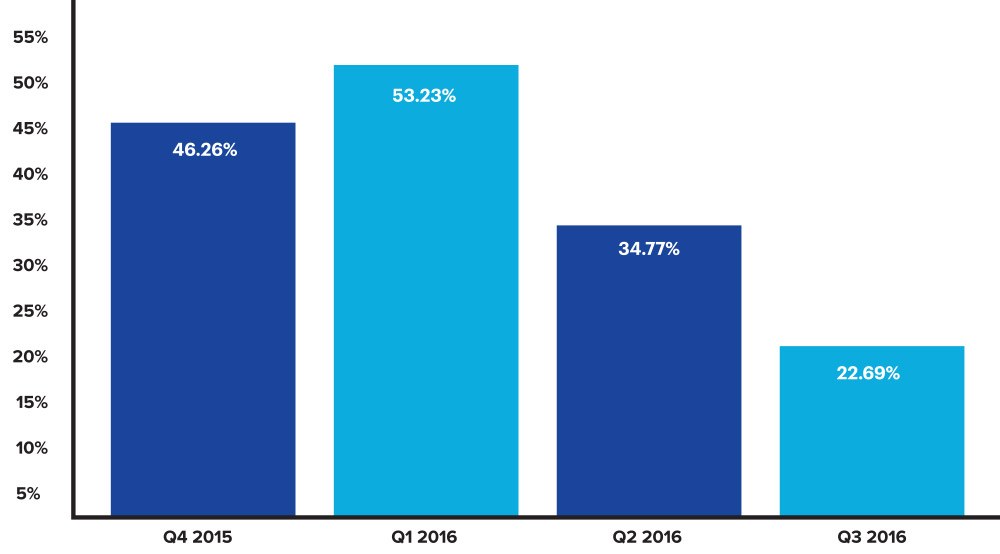

Figure 3 shows the proportion of Legal/Regulatory/Compliance defects relative to all critical defects found in the most recent four quarters. As can be seen in the chart, the Legal/Regulatory/Compliance category showed a notable decrease in reported critical defects in Q3, even though as a percentage of overall reported defects, this category rose to 38.9%, (a 14.4% increase from Q2 to Q3) and remained the highest reported defect category.

The categorization of the severity level of TRID-related defects in the prior three quarters was very consistent across our lender base. Across our broad span of lenders, methodologies for the identification and reporting of TRID-related defects were fairly similar. As a comparison of overall defects vs. critical defects, quarter to quarter we saw no deviations greater than 2% (I.e., the percentage of overall defects was very much aligned with the percentage of critical defects). However, in our review of Q3 data, we saw changes in lenders’ reporting processes. Specifically, the levels of severity assigned to TRID-related defects are being downgraded across the board and also differ from lender to lender. The Q3 data provides deep insight into evolving industry thinking around the relationship between certain defects within the Legal/Regulatory/Compliance category and how they impact the critical defect rate. Lenders are reducing their view of the severity of certain TRID defects, leading to a drop of over 34% in the Legal/Regulatory/Compliance category as a percentage of all critical defects (now representing 22.7% of critical defects – a 12 month low).

Through the early months of 2016, lenders were battling investors on eligibility issues pertaining to the sale of loans that contained TRID related defects. During the past 9 months, investors and lenders have been able to clarify the impact of TRID-related errors on their operations and fine-tune the associated risks – both short and long term. Lenders acted and made the necessary changes to improve their manufacturing processes and from Q1 to Q2 we saw a noticeable reduction in overall defects. In Q3, a greater emphasis was placed on avoiding risks that are associated with critical defects as lenders were more effectively able to truly associate risk (loss) with their reported TRID defects.

In Q3, we see that many TRID errors are still happening within the origination process. However, there are notable drops in the severity levels that are being assigned to these defects by lenders. This re- assignment appears to be based more on an organization’s review and interpretation of risk. As an example, a defect that was identified earlier in the year that involved a tolerance violation resulted in a borrower refund of $75. This may have been graded earlier in 2016 as a critical defect and treated the same as a tolerance violation resulting in a refund of $2,075. After all, both defects involve an error and a refund to the consumer. As marketplace thinking evolves, our data is showing that lenders have established risk levels within their organization to better associate risk levels to the organization’s risk tolerance. A tolerance violation of $75 may now be graded as a moderate risk due to the overall risk it represents at an organization level. On the other hand, a $2,075 defect would be classified by most lenders as “critical.”

The changing perception of risk associated with different types and levels of TRID defects is resulting in the divergence noted above between an increasing level of Legal/Regulatory/Compliance overall defects but a falling level of critical defects for the industry overall and for this category.

Legal/Regulatory/Compliance as a Percentage of the Total Defects, Q4 2015 — Q3 2016

Figure 3: Legal/Regulatory/Compliance defects as percentage of total defects by quarter.

QC Industry Trends — Credit Focus

QC Industry Trends — Top Credit Related Critical Defects

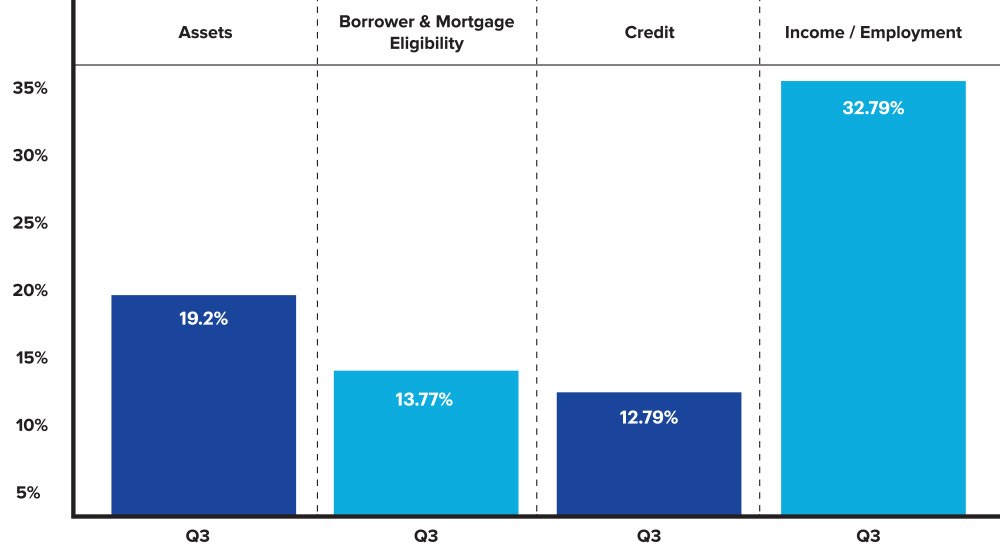

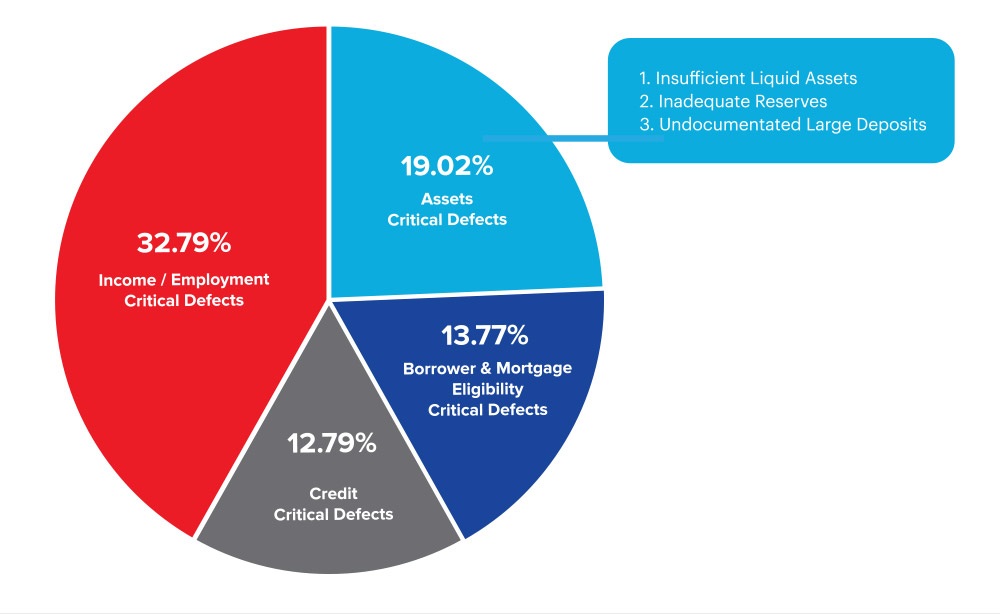

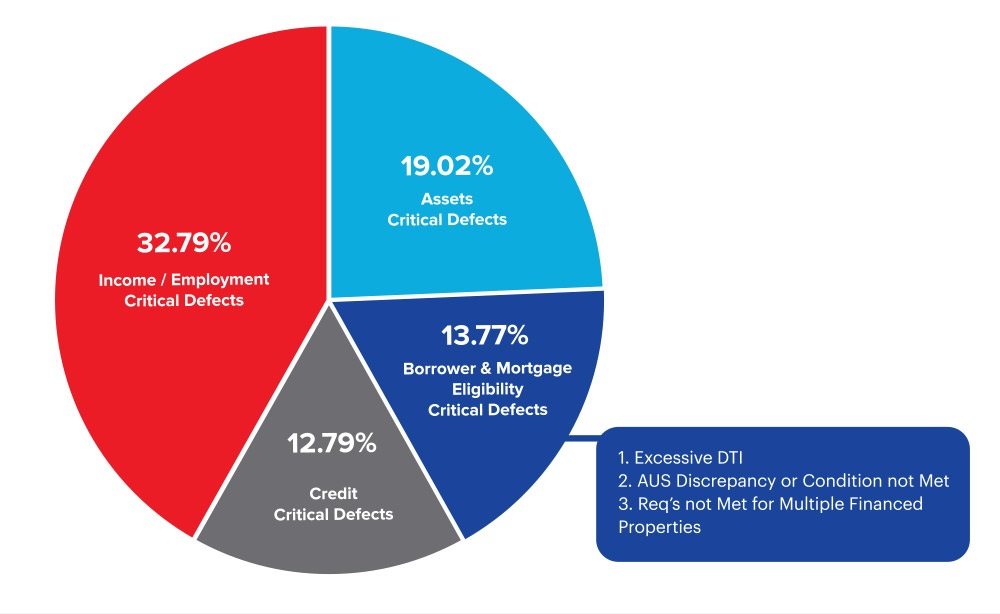

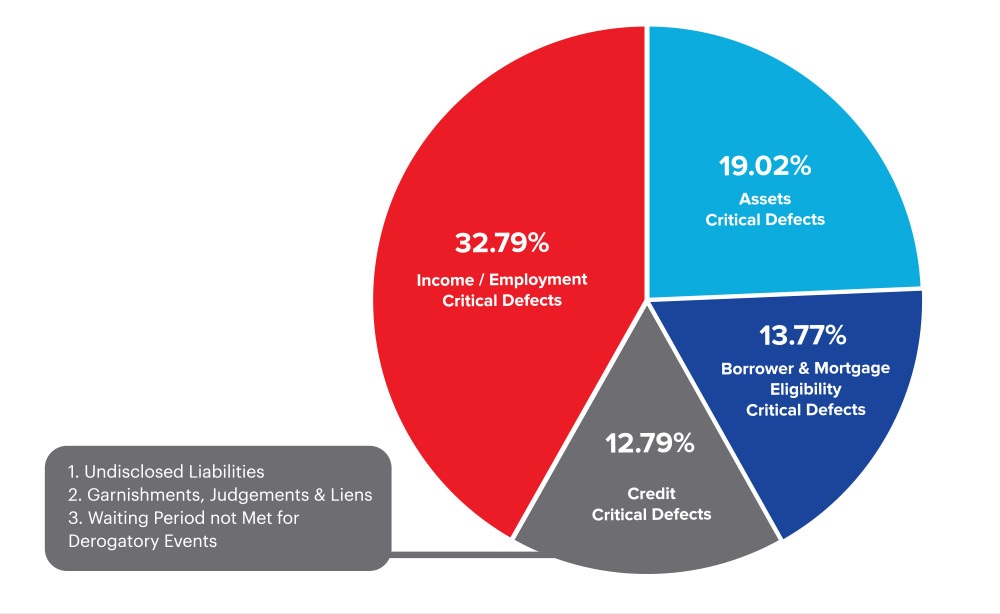

Figure 4 provides a summary view of the top 4 “Credit Defect” categories and the percentage of critical defects associated with each category for Q3 of 2016. Income/Employment defects continue to be the biggest credit issues for lenders, making up 32.79% (increased from 26.15% in Q2) of critical defects across all credit defect categories. Assets, making up the second highest Credit Defect category, increased to 19.02%, followed by Borrower and Mortgage Eligibility at 13.77% and Credit defects reported at 12.79%.

Top Critical Defects for Credit Categories, Q3 2016

Figure 4: Breakdown of Critical defects – top four credit related categories

Figure 5 provides a breakdown of the Income/Employment defect category as a percentage of the overall critical Credit related defects. The Income/Employment category is the highest Credit category accounting for 32.79% of all Credit related critical defects in Q3. To further detail this category, we have identified the top three reported critical defects associated with Income/Employment, which are all related to the improper calculation of Rental Income or Loss, Bonus / Overtime / Commissions and Self- Employment Income.

Income/Employment, as a Percentage of All Defects "Credit-Related Defects", Q3 2016

Figure 5: Breakdown of critical defect Income/Employment Q3 2016.

Figure 6 provides a breakdown of the Assets defect category as a percentage of the overall critical Credit Defects. In Q3, the Assets category accounted for just over 19% of all Credit related critical defects. To provide further detail of the Assets category, we have identified the top three reported critical defects associated with Assets: Insufficient Liquid Assets, Inadequate Reserves and Undocumented Large Deposits.

Assets, as a Percentage of all Critical Credit-Related Defects, Q3 2016

Figure 6: Breakdown of critical defects Assets Q3 2016.

Figure 7 provides a breakdown of the Borrower and Mortgage Eligibility defect category as a percentage of the overall critical Credit related defects. In Q3, the Borrower and Mortgage Eligibility category accounted for almost 14% of all Credit related critical defects. To provide further detail of the Borrower and Mortgage Eligibility category, we have identified the top three reported critical defects associated with Borrower and Mortgage Eligibility: Excessive DTI, AUS Discrepancy or Condition(s) not met, and Requirements not met for Multiple Financed Properties.

Borrower and Mortgage Eligibility, as a Percentage of All Critical "Credit-Related Defects", Q3 2016

Figure 7: Breakdown of critical defects Borrower/Mortgage Eligibility Q3 2016.

Figure 8 provides a breakdown of the Credit Defect category as a percentage of the overall critical Credit related defects. In Q3, the Credit category accounted for almost 13% of all Credit related critical defects. To provide further detail of the Credit category, we have identified the top three reported critical defects associated with Credit: Outstanding Garnishments, Judgements, Liens, Waiting Period Not Met for Significant Derogatory Events, Undisclosed Liabilities.

Credit, as a Percentage of All Critical "Credit-Related Defects", Q3 2016

Figure 8: Breakdown of critical defects Credt Q3 2016.

Conclusion

In Q3 2016, as in the previous two quarters, Legal/Regulatory/Compliance defects were the major driver of the overall defect rate as lenders continued to make adjustments in the implementation of TRID requirements. At the same time, the reported increase in overall TRID defects and the decrease in critical defects associated with TRID provides initial evidence that industry-wide changes are being implemented to more accurately identify and measure defects in accordance with an individual organization’s tolerance for risk. The industry appears to be gaining a comfort level with the TRID requirements and how both short and long term risk can be managed. With the ability to dive deeper into other defect categories, we can clearly identify the recurring defects from the top defect categories provides insightful information as to where corrective action planning needs to be focused.

Fannie Mae has provided much guidance to lenders as to how defects are reported for “Credit Related Defects” and what causes a defect, the risk associated with a defect and how to report these defects under a standardized platform. To date, no similar guidance has been provided by the CFPB regarding TRID effects. Based on our analysis of Q3 industry defect data, we would recommend that industry groups advocate to the CFPB for similar standardization on the regulatory front. Guidance from the CFPB regarding classification and severity of TRID-related defects could prove very beneficial to the standardization of future industry reporting on this front.

Fannie Mae Selling Guide – D1-1-01 Quality Standards and Measures:

At a minimum, the lender must identify any loans with a defect (loans not in compliance with the Selling Guide or other related contractual terms and agreements) and establish a methodology by which all loans with identified defects can be categorized based on the severity of the defect. The lender must define the severity levels appropriate to its organization and reporting needs, however, the highest level of severity must be assigned to those loans with defects resulting in the loan not being eligible as delivered to Fannie Mae.

About the ARMCO Mortgage QC Industry Trends Report

The ARMCO Mortgage QC Industry Trends Report represents post-closing quality control analysis throughout the United States using data and findings derived from mortgage lenders utilizing the ACES Analytics benchmarking software. This report provides an in-depth analysis of residential mortgage defects as reported during post-closing quality control audits. Data presented comprises net defects and is categorized in accordance with the Fannie Mae loan defect taxonomy.

About ARMCO

ARMCO – ACES Risk Management delivers web-based audit technology solutions, as well as powerful data and analytics, to the nation’s top mortgage lenders, servicers, investors and outsourcing professionals. A trusted partner devoted to client relationships, ARMCO offers best-in-class quality control and compliance software that provides U.S. banks, mortgage companies and service providers the technology and data needed to support loan integrity, meet regulatory requirements, reduce risk and drive positive business decisions. ARMCO’s flagship product, ACES Audit Technology™, is available at any point in the mortgage loan lifecycle, to any size lender, and is user-definable. ACES standardizes audit requirements, ties pre-funding reviews to post-closing quality control audits, enables seamless trend analysis, identifies credit, compliance and process deficiencies and helps create manageable action plans. For more information, visit www.acesquality.com or call 1-800-858-1598.

MEDIA CONTACT:

Joe Bowerbank

Profundity Communications, Inc.

949.378.9685

jbowerbank@profunditymarketing.com