Click the link to read the entire article.

Compliance Newshub

Industry News

This topic consolidates the heartbeat of today's mortgage banking environment with news stories relevant to the financial compliance industry.

This topic consolidates the heartbeat of today's mortgage banking environment with news stories relevant to the financial compliance industry.

Click the link to read the entire article.

Click the link to read the entire article.

Search our Compliance Calendar for current regulatory changes & updates.

MBA NewsLink: In today’s lending market, where every dollar counts, revenue retention areas such as quality control (QC) and compliance have become more critical than ever.

Defect rate declines 19.18% year-over-year, illustrating the vast improvement in lenders' loan quality efforts

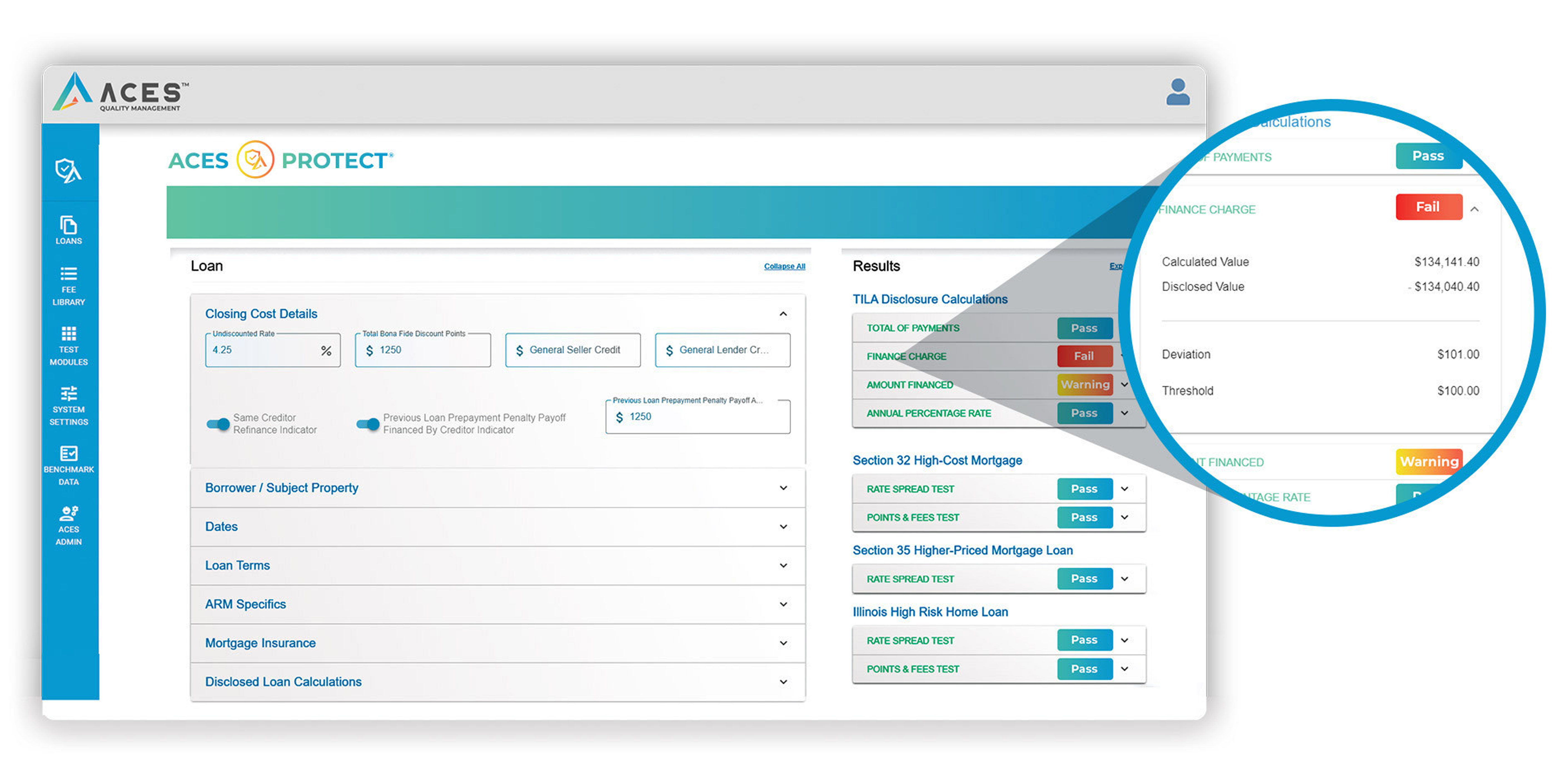

Automated compliance tests to ensure compliance on more loans in less time

Click the link to read the entire article.

Please click the link to read the full article.

Click the link to read the full article.

Click the below link to read the full article.

"ACES has shined a light on our productivity and empowered us to hold our teams accountable."

- Emilee Rada, Director of Lending Operations at Georgia's Own Credit Union

Click below to read the full article.

Clink the link to read the entire article.

Click the link to read the entire article.