FTC Business Blog- by Lesley Fair

An automotive group recently settled an FTC complaint alleging multiple areas of discrimination against Black and Latino customers throughout the purchase and financing of vehicles.

This topic consolidates everything you need to know to stay informed including prominent industry advocacy movements, current regulatory enforcement actions, and judicial rulings impacting mortgage banking.

FTC Business Blog- by Lesley Fair

An automotive group recently settled an FTC complaint alleging multiple areas of discrimination against Black and Latino customers throughout the purchase and financing of vehicles.

The Consumer Financial Protection Bureau, the Federal Reserve Board, and the Office of the Comptroller of the Currency announced that the 2023 threshold for exempting loans from special appraisal requirements for higher-priced mortgage loans will increase from $28,500 to $31,000.

Search our Compliance Calendar for current regulatory changes & updates.

The CFPB filed a complaint against MoneyLion Technologies, Inc. and the MoneyLion lending subsidiaries for allegedly violating the Military Lending Act and the Consumer Financial Protection Act by imposing excessive charges on loans to servicemembers and their dependents.

Weiner Brodsky PC- Financial Services Update

A punitive class action suit has been allowed to continue in the U.S. District Court for the Northern District of New York (NDNY) related to an accountholder’s allegation that multiple overdraft fees were assessed and collected for the same item.

Department of Justice

A federal grand jury has indicted German Antonio Lopez-Velasquez, Marko Antonio Lopez, and Lisa Marie Santos for bank fraud and conspiracy to commit bank fraud, utilizing false documents, fictional companies, and fictional individuals to obtain mortgage loans for borrowers who were not qualified to receive loans resulting in over $10 million in at least 30 loans.

Mortgage Professional America--Richard Torne

A whistleblower, former employee for a non-QM firm has condemned the lending practices at his former company, asserting that rules were bent on a regular basis to approve suspect loans.

"ACES has made my life so much easier from a QC perspective. It's life-changing"

- Kelly Cooper Spencer, QC & Business Intelligence Data Manager at Thrive Mortgage

The Consumer Financial Protection Bureau (CFPB) issue a circular confirming that financial companies may violate federal consumer financial protection law when they fail to safeguard consumer data.

A 72 year old resident of New Orleans, Louisiana, was sentenced on August 4, 2022 for mortgage fraud and sentenced to time served, 5 years of supervised release, $751,900 in restitution, and a mandatory $100 special assessment fee.

The CFPB has taken action against U.S. Bank for illegally accessing its customers’ credit reports and opening checking and savings accounts, credit cards, and lines of credit without customers’ permission and pressured and incentivized its employees to sell multiple products and services to its customers, including imposing sales goals as part of their employees’ job requirements leading to U.S. Bank employees unlawfully accessing customers’ credit reports and sensitive personal data to apply for and open unauthorized accounts.

Mortgage Professional America--Tony Cantu

Three more co-conspirators are in custody on charges related to a multi-layered mortgage fraud, credit repair and government loan fraud scheme, two of which were indicted in January on numerous charges for participating in a conspiracy to defraud mortgage lending businesses, banks, the Small Business Administration, and the Federal Trade Commission, according to the complaint.

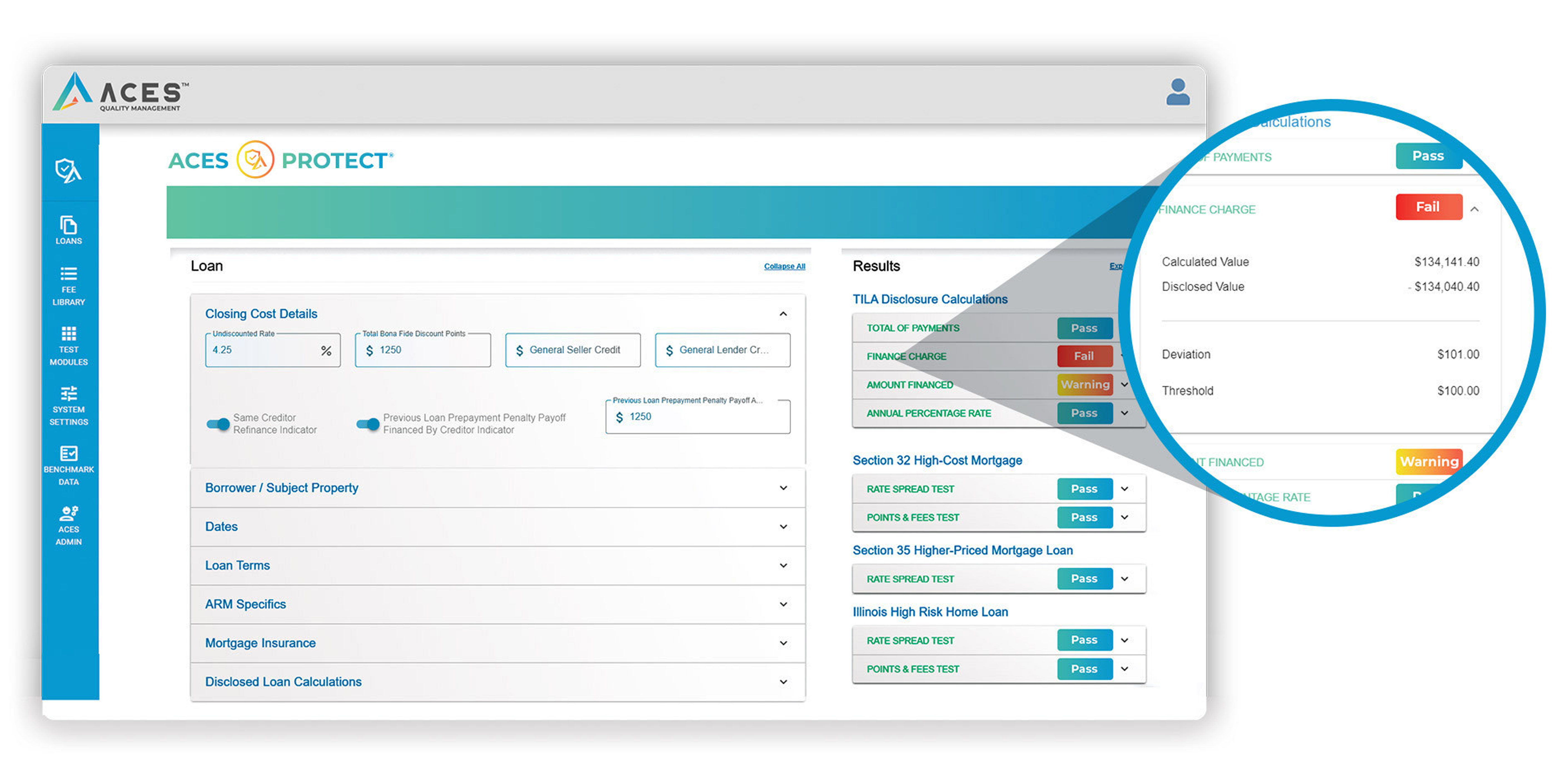

Automated compliance tests to ensure compliance on more loans in less time

Compliance Alliance

Mohamed A. Awad, of Florida, was arrested on July 21, 2022, on charges related to his role in fraudulently obtaining over $1.6 million in federal Paycheck Protection Program (PPP) loans and Economic Injury Disaster Loan (EIDL) payments.

Mortgage Fraud Blog

American Financial Network, Inc has agreed to pay over $1 million to resolve allegations that it inappropriately and fraudulently originated government-backed mortgage loans insured by the Federal Housing Administration (FHA), a component of the U.S. Department of Housing and Urban Development (HUD).

National Mortgage Professional--Keith Griffin

American Financial Network Inc will pay $1,037,145 to resolve allegations that it improperly and fraudulently originated FHA loans after a complaint was received from a whistleblower that is a former loan processor for the company.

A California man was extradited from Mexico on March 8 and pleaded guilty on June 24, 2022, to conspiracy to commit mail fraud and wire fraud, mail fraud, and money laundering charges for two high-yield investment fraud schemes.