HousingWire--Sarah Wheeler

ARMCO's DataSure provides robust data validation technology for greater lender efficiency

Executive Conversations is a HousingWire web series that profiles powerful people in the financial industry, highlighting the operations and the people that make this sector tick. In the latest installment, we sit down with Phil McCall, president of ARMCO, to talk about the importance of data integrity, and how lenders can use quality control technology to increase their efficiency while reducing risk.

Q. What sort of risk do lenders face when it comes to data integrity?

A. Lenders usually feel the pain of data errors when they go to sell their loans. The GSEs require uniform data sets, so when documents have inconsistencies or missing data, the purchase process is delayed until those issues are addressed. Data integrity issues often lead to price adjustments.

A. Lenders usually feel the pain of data errors when they go to sell their loans. The GSEs require uniform data sets, so when documents have inconsistencies or missing data, the purchase process is delayed until those issues are addressed. Data integrity issues often lead to price adjustments.

Bottom line, lenders are often losing money because of incorrect data.

Another big risk is from the regulatory agencies, who are pushing back on lenders and making them fix errors on loan application records as far back as three years. For example, the CFPB could identify data integrity errors during a HMDA audit and require a full re-submission of a lender’s LAR data for up to three years.

This could put a major strain on resources because this type of re-submission usually needs to be completed with a three to four month period. A mid-size lender taking in 25,000+ applications per year could be required to research, re-validate and re-enter data for 75,000 applications or more.

No lender has those resources available and outsourced resources who handle these types of situations are costly. They can make the fines levied for these types errors look small in comparison. It’s hard to put an exact dollar amount on that work, but it’s significant and real.

Q. Why is this risk rising?

As the industry evolves to digital mortgages, lenders are processing new data sources virtually every week, but those data sources don’t all speak the same language. So, lenders are manually keying information into their LOS, multiplying the risk of errors and expending a lot more time.

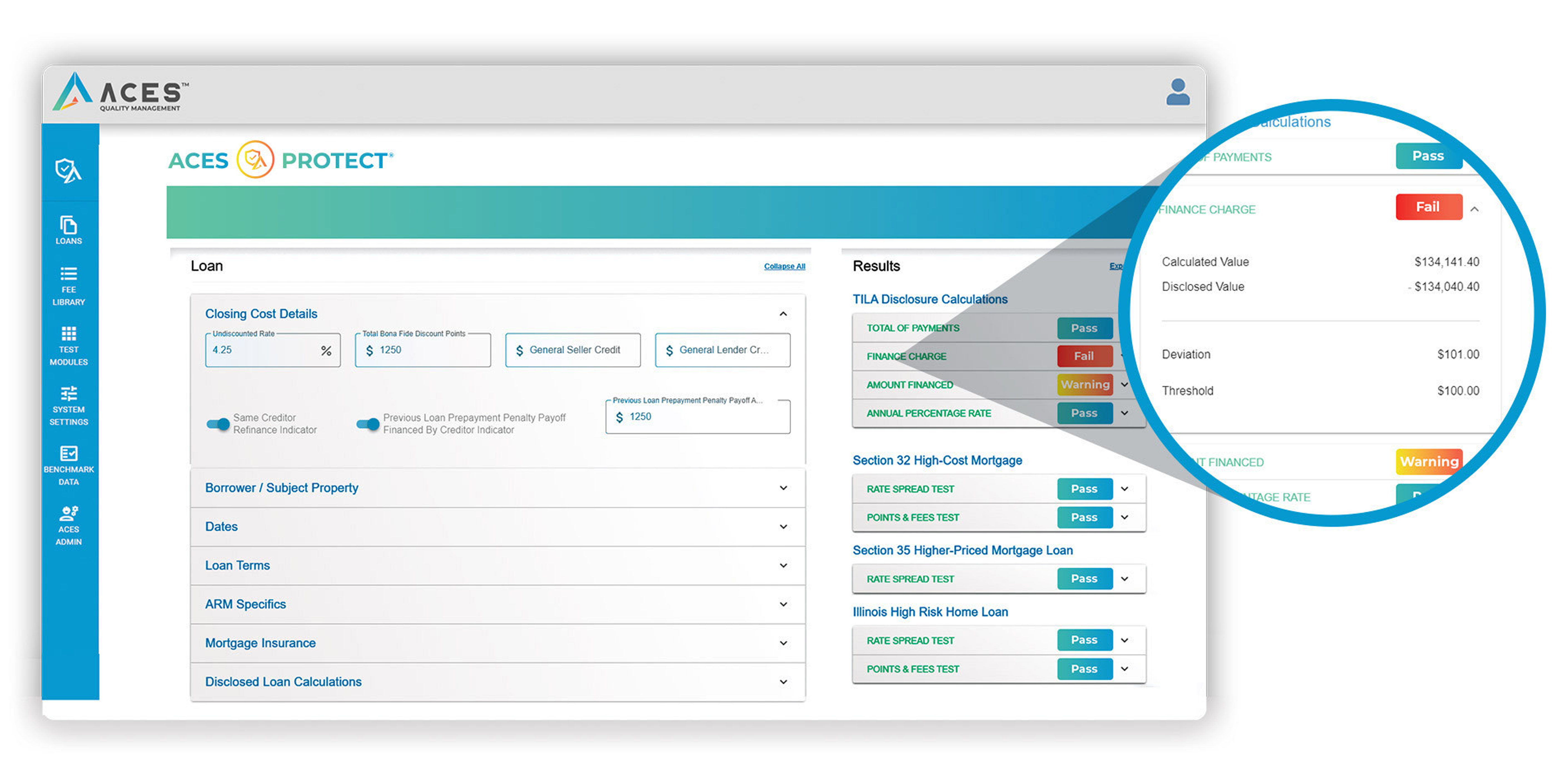

Lenders need a translator that standardizes and compares all of these data sources, then systemically identifies errors. That’s why ARMCO launched DataSure. DataSure improves the accuracy of a lender’s data while shortening pre-funding and post-closing timelines.

Q. How does DataSure improve data quality?

In short, DataSure assures that the data in the loan file accurately reflects the data on loan documents. It does this by automatically parsing and evaluating data on virtually any type of loan document, cross comparing that data to the lender’s source system – which is usually their LOS – and automatically communicating all corrected data fields back into that system.

Lenders usually handle this process manually using the “stare-and-compare” method, which of course, isn’t just error-prone, it’s also a tedious, time-consuming strain on some of lenders’ most costly and skilled staff positions.

Q. How does DataSure increase lenders’ efficiency?

First, it virtually eliminates manual and repeat activity in the data validation process. As we worked with our pilot clients, we’ve seen DataSure improve the core efficiency of personnel by more than 50%.

Almost all lending shops have a post-close department where people complete the data validation process, often using a manual checklist where they compare data from documents and fields in their LOS and make sure it all matches. You might have 15 people whose job is just cleaning up the data at the end of the loan process, and they still couldn’t get through all the loans at that point.

But often, the loan gets moved to another area — say, capital markets — and that team doesn’t trust the work being done on validation and so they review the initial review! DataSure has multiple triggers throughout the whole manufacturing process so 75% of all the data is already validated by the time it gets to the end of the process.

Secondly, DataSure streamlines the process because it uses business rules to make decisions on which data is correct when there is a discrepancy. Our engine is driving the answers, instead of a human making decisions. Lenders don’t need to hire experienced mortgage industry professionals to analyze loan data. DataSure does the same type of review every time in a repeatable process that happens the same way for every loan that gets reviewed.

Lenders using DataSure are able to increase the efficiency of their employees and reduce FTE expenses while solving their long-term risk.

To find out more about DataSure and how it can help you reduce the risk of inaccurate data, visit the website here.

A. Lenders usually feel the pain of data errors when they go to sell their loans. The GSEs require uniform data sets, so when documents have inconsistencies or missing data, the purchase process is delayed until those issues are addressed. Data integrity issues often lead to price adjustments.

A. Lenders usually feel the pain of data errors when they go to sell their loans. The GSEs require uniform data sets, so when documents have inconsistencies or missing data, the purchase process is delayed until those issues are addressed. Data integrity issues often lead to price adjustments.